A shift towards using cannabis as an alternative to alcohol, particularly among the Gen Z age group, has been observed, as per a study conducted by the data company Brightfield Group. The research revealed that changing societal norms and a growing emphasis on health are causing consumers to modify their alcohol consumption patterns.

Brightfield Group’s research since 2021 reveals a significant change in alcohol consumption habits. In the first quarter of 2023, 60% of alcohol users reported a reduction in their drinking, a small but meaningful increase from the starting point of the study.

The decrease in alcohol consumption has largely been driven by “Wellness Seekers,” a demographic that follows the most recent wellness fads and stress management techniques. By the first quarter of 2023, a remarkable 72% of Wellness Seekers claimed to drink less alcohol, which is a considerable leap from the 67% recorded in the middle of 2021.

The increase in cannabis usage as a chosen alcohol substitute is a trend that cannot be ignored. With the legalization of marijuana becoming more widespread, leading to easier access, 37% of Gen Z individuals revealed a preference for cannabis over alcohol.

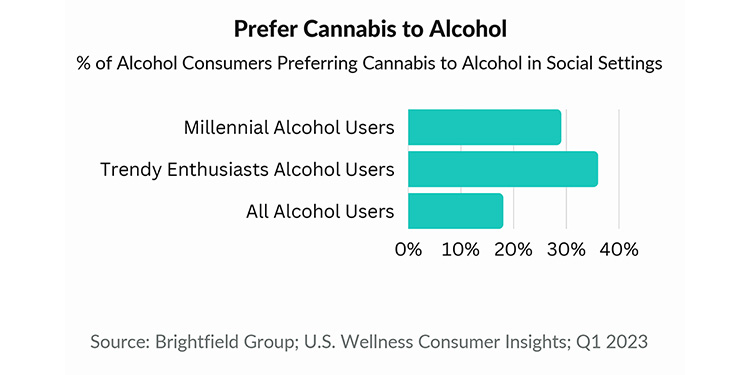

As per Brightfield’s statistics, 18% of alcohol consumers would rather use cannabis in social gatherings, a preference that’s even more noticeable among millennials, with a figure of 29%.

While classic choices like tea and soda continue to be the most popular alternatives to alcohol, a consistent interest in new non-alcoholic alternatives suggests consumers are seeking more innovative, pleasurable options.

Non-alcoholic beer consumption has grown by 6% among “Trendy Enthusiasts,” a group known for being at the forefront of societal trends. These consumers, along with a group referred to as “Better Way Believers,” show a notable reduction in alcohol usage and an affinity for established methods of maintaining wellness.

The ongoing trend of decreased alcohol consumption is undeniably beneficial for the cannabis industry. The growing acceptance of marijuana as a feasible alternative, particularly among younger demographics, suggests a possible expansion path for industry stakeholders.

Nevertheless, the challenge of making cannabis beverages conveniently available to consumers remains. In the absence of universal regulations and effective platforms for purchasing and sampling, it is hard to determine the actual demand for these products.

This dilemma has led many companies, under pressure from quarterly shareholder expectations, to abandon their cannabis ventures and focus solely on their alcohol profits, reversing initial aspirations and plans.

Despite this, the increasing recognition of cannabis as a social alternative to alcohol lays down a hopeful trajectory for innovation and growth – even more so for those with the resources to invest in this long-term strategy – spurred by a generation’s intrigue and appetite for alternatives to the traditional alcoholic buzz.