The blossoming cannabis industry is undergoing continuous change as more states give it the green light and as businesses seek to capitalize on the growing curiosity of the public.

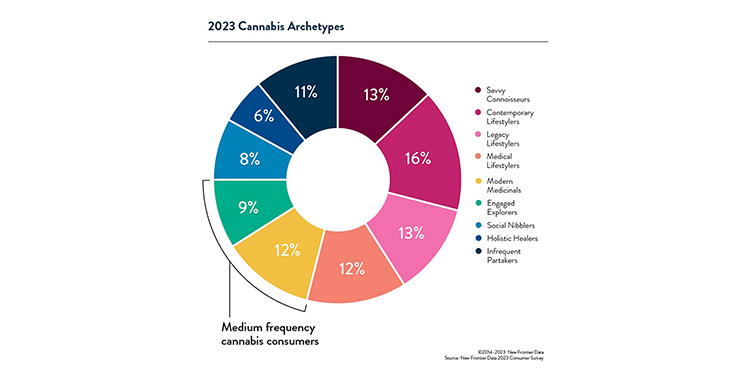

In particular, mid-range cannabis consumers are playing a pivotal role in the market, serving as valuable models for various product forms, as highlighted in the recent report “American Cannabis Consumers 2023 Part 2: Unveiling the Archetypes” by New Frontier Data.

“Whilst several brands cater to the most frequent users, intermediate users possess unique qualities that are appealing to firms that are designing new and wellness-oriented delivery methods,” noted Molly McCann, the lead for consumer insights at New Frontier Data.

The Mid-Range Consumer Archetypes

Two archetypes are recognized within the mid-range consumer segment by the report:

- Contemporary Medicinals

- Active Adventurers

Representing 12% of consumers, Contemporary Medicinals are primarily medical cannabis users. They prefer non-combustible cannabis products such as edibles, vapes, tinctures, and topicals. Most of the Contemporary Medicinals source their cannabis from regulated dispensaries and delivery services, which offer dependable supplies of non-flower products.

On the flip side, Active Adventurers, accounting for 9% of consumers, primarily use cannabis for recreational purposes. They often prefer non-flower forms like vapes and edibles, but sometimes they do smoke cannabis. These adventurers usually reside in regions where adult-use is permitted and have a vast array of products to choose from, with dispensaries being their top source.

Emerging Influence

The market segment of mid-range consumers is becoming more prominent, with the Contemporary Medicinals and Active Adventurers archetypes experiencing significant growth over the last year. While these consumers might not use cannabis as often as other groups, their contribution to the legal market is considerable.

What’s more, Contemporary Medicinals and Active Adventurers are the most dependable retail customers. They mostly source from legal cannabis retailers (dispensaries and delivery services), with 81% of Contemporary Medicinals and 82% of Active Adventurers doing so, in contrast to the average of 55% across all consumers.

“In both scenarios, these archetypes’ dependence on regulated outlets is connected to their preference for value-added product formats; regulated sources typically provide significantly superior quality and a broader range of non-flower products,” McCann stated.

The enhanced availability of a wide array of products is guiding the market towards the creation of innovative and wellness-focused delivery methods. As the wave of legalization continues across more states, these mid-range consumer archetypes are anticipated to influence the strategies and offerings of cannabis companies.

CHECK THIS: Difference in Delta-9 and Delta-8 THC: Clarifying the Confusion